Wow, it's crazy I haven't posted for a week. I guess with the holiday weekend I didn't really do anything. Lately I have not really traded at all, and when I have I have taken losses. I day traded GOOG and AAPL, both times I followed my rules and exited when it broke trend on what I was watching. This is frustrating at the same time because at different times during the day I would have been at a profit and not a loss. However, to get to that profit I would have had to hold through a large loss, and I am never guaranteed that the loss will reverse, so I was technically correct in my actions and it will be helpful in the long run as far as probability and success goes but I still hate to take losses. Not to mention I was thinking back to where I was before and thinking if only I knew then what I knew now I would still have a majority of that cash. Instead I am back down close to my lows after the whole CROX situation, and since then I have dropped even more but that was with following rules.

I really can't dwell on it, there were lessons to learn and unfortunately it was very expensive to learn them. Jeff is very right, it is hard to trade in this market, if it is in fact a bear market.

Part of me wants to just sit out if it's a matter of capital preservation and its much easier to trade in a bull market. Although I have no idea when we would get into a bull market again(if we are in fact in a bear market). And I really want to learn to trade or at least survive in a bear market but I now feel undercapitalized again, which could be good because I'll take less risk but I will really have to be religious about my rules, as I should be anyways.

I can definitely see how some people can get fed up, I have drawn my account down 3 times now to this level, two other times were just because I was taking too much risk, this one partially that reason because of CROX, so I guess that explains it, however to keep giving that money back wears on you. I am by no means going to quit at all, it just means I have a lot more learning to do, but to learn I must trade, and survive to trade.

Today I tried to enter puts at the close on the SPY, Ameritrade was messing up and didn't fill the order for some reason so I cancelled and decided I would wait till tomorrow to take a position and day trade it. I can't believe these two rallies, as Jeff and Eric said, the sharpest rallies happen in the context of a bear market, its crazy to think though that the market can jump 5% on news of a possible rate cut, which in reality would do nothing for the present times. I am inclined to buy puts tomorrow if we do not break above 1475 on the S&P, I think if we start up again tomorrow we will give it back during the day, but if we start down we will continue down, again who knows I will have to watch the chart but that is what seems logical to me.

Bottom line is this volatility is tough, I wonder if in a bear market it's better to use a time stop, like give myself a time period to be right and if it doesn't happen within that given time period I exit. That partially seems wreckless because it could result in larger than 2% losses which is what I should still limit myself to.

Tomorrow is always another day to trade and make money back, but I could also lose, which is what I don't want to do so it is making it harder to be a mechanical trader.

Wednesday, November 28, 2007

Wednesday, November 21, 2007

Watch Out!

Sorry, I have slacked a bit lately. Yesterday was very frustrating. My original plan of buying on the open would have been very profitable, but I didn't do it so as GOOG got away from me I figured I would make money on the way back down as people took profits. I tried to pick a top a little too early. Again, my thought process was correct but I didn't give it enough time, although I thought I was following the chart, so when it looked like it was bouncing off 650, I exited at a 4% loss, had I held for another 20-30 mins I could have had a 8% gain assuming I got out reasonably near the bottom, which would have been my target actually.

All of that stuff is easy to say after the fact, do I go with logic and conviction or only the chart, or am I not reading the chart well enough? What was the difference between a profit and loss in that case?

The Dow was all over that day 140 gain then 100 loss, back to a 100 gain to finish up 50 I believe. Crazy volatility. Had I held till the end of the day I likely would have been in the same situation if not slightly worse then selling when I did anyways, I can't tell if that is good or not, I would have rather just made a profit regardless. So I erased my gain from the other day and a little bit more.

I am currently sitting out till after the weekend. GOOG and AAPL were holding up well on this big down day but I didn't want to be buying options just to have them decay until friday with light volume.

This could be big, the S&P broke below 1425, we are flat on the year now and a break below 1400 would signal a real break of the 5 year uptrend of the market. Preservation of capital will be big right now, I will have to go for small gains if I do, which could be challenging for me but if I want to be able to keep trading I have to. Jeff has said that in bear markets, everyone loses, its just a matter of who loses less. That's tough to already be down facing that, maybe I should sit out for a while. However, I also feel this will be a huge learning experience because it has been said that if you can trade through a bear market and survive you can trade through anything.

We'll see what happens. Have a Happy Thanksgiving, for those that celebrate it, even though it is a silly thing to celebrate, the holiday is nice.

Monday, November 19, 2007

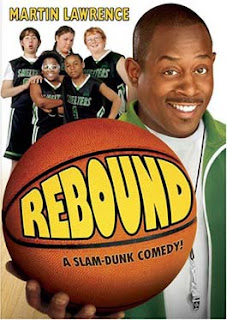

Rebound?

Damn Gina!

No, not Martin Lawrence's possibly funny family comedy(I haven't seen it), the stock market. Will we rebound here or continue down?

Alright, we technically shouldn't care, just react to market conditions but there are quite a few things to consider. We finished below 13,000 on the Dow, which is a fairly significant psychological number, which then argues that it is a technical level also. However this was on lower than average volume(due to the holiday shortened week) and historically this is a bullish week for the stock market going into the biggest shopping day of the year. The S&P has found support in the 1430 range and I referenced it earlier, so it would be a good sign for a decent bounce here, one of the reasons I feel like we will get a bounce tomorrow is HPQ's earnings came out and beat expectations and gave a good forecast and announced a stock buy back, so if nothing else tech may be the place to be if you are bullish. I will likely watch GOOG or AAPL tomorrow for a day trade opportunity.

Today, I took a trade on the SPY, bought some calls, but it broke trend shortly there after and I exited at a about a 200 dollar loss, not the biggest deal, less than 1% of my account, however losses still suck. Had I held till the end of the day I would have pretty much been where I was when I originally exited, but it was higher for a bit of the day.

I kind of want to go back and look but it seems like on down days we rally in the 1-2pm area, and on up days we could sell off at that time too, and then the trend usually continues afterwards if its a strong trend after 2pm. so people will start to lock in profits depending on if they are short or long, by covering or selling off in that time period.

I still struggle on taking anticipatory trades because those can be much more profitable because you will gain the gap up or gap down in a stock for the next day, but that is more risky, so at this point i'd rather go for a smaller move that is more likely since I am below even. If I were up decently, it would make more sense to take a bit more risk with pure profit, but at this point that is not the case.

The futures are up right now, but we'll see how they shape up tomorrow I am thinking we go higher on the day with the largest gainer being the Nasdaq. If the futures are up decently in the morning I may buy at the open.

Thursday, November 15, 2007

Day Off

I didn't do any trading today, I did watch some stocks today, and most of them went down. When we rallied the other day we went back up to the critical level of 1490 and could not break it. We now have a technical downtrend on the indices with the lower high and lower low. Is it a bear market? In the short term it seems it may be. With increased volatility and option prices generally higher I may stick to strictly day trading, or sitting on the sidelines since I cannot sell options at this point. I'll likely be looking for the next rally so I can get some puts on good looking setups.

I am hoping to do some trading tomorrow but may have to travel during market hours so we shall see.

Day Trading

Ok, so I figured I would detail what I am looking at during a possible day trade scenario. Krystal had a lot of good questions so I figured I would try and answer them with what I am looking at and doing. Again, I am not a professional nor a successful day trader but this is what I have observed.

Someone on Jeff's Option Addict blog asked if you could really apply the same type of chart set-ups to short term trades compared to intermediate. In theory, you should be able to apply technical analysis to any time frame and from what I have seen this is true, you just have to determine what you want to trade.

When I want to trade I want a stock that is liquid and has large ranges, I mean you could technically buy a lot more contracts(if you are trading options) and only go for a smaller move on a slower moving stock, but I'd rather pay less in commissions and get the same profit potential with a stock like GOOG or BIDU. I chose GOOG to look at.

How do I pick the option I am trading? Generally I will try to determine a reasonable move and pick an appropriate OTM option, I see no reason to not trade more OTM contracts simply because you are only holding for the day so time and volatility decay should be at a minimum. Always keep in mind your risk and know where you will exit, that will determine the amount of contracts I purchase.

To figure out where to get in determine your sentiment and watch the chart, if you were bearish on the day to begin with, which I was, you could buy puts at the open, but it'd probably be smarter to let the pattern form. You can see the down trend marked by "A". It is a classic example, lower highs and lower lows. So, if you entered at the top of "A" then you would exit where it broke the down trend.

It then entered a sideways channel 1 marked by "B". Again if you wanted to enter a trade, you could either take bounce or anticipatory trades at support and resistance, however you would likely want to wait for confirmation of a break either way then you would exit if it entered back in the channel or if it reached your target.

This chart is a 1-min 1 day chart(technically it shows 2 days I couldn't help it it is into tomorrow, sorry). But that is generally what I look at, or a 1-min 4 hour chart. We can see the downtrend marked by "C", you could have used that as a much shorter term trend trade, again proving that you should be able to use Technical Analysis on any time line. That trend ended up also breaking the lower channel support, you can then see the stalls and mini channels it formed marked by 2 and 3. Both followed rules of the downtrend not breaking back above, so technically you would still be in the trade if you entered after a break of the Channel C.

Downtrend "D" again, after a few lower highs and lower lows you can draw a trendline and use that. You would have gotten a lot more money out of the trade staying in till it broke right at the bottom but if you had another exit trigger you such as a target being reached then follow that. Again, have a plan and trade it and define your risk.

Hopefully that helps some and gives some insight on what I am thinking and what is possible on a short term basis. This may not work for some and I can't say it necessarily is suited to my style yet either but success should be possible just like any other timeline if you follow rules and the charts.

I didn't take those trades because I worked most of the day however I did watch them as they developed though.

Tomorrow I think will determine our direction, if we have bearish data we will go back down, if it's bullish we could break back above the all important 1490-1500 level on the S&P.

Tuesday, November 13, 2007

The Contrarian Trade

So the Dow is goes up 319, the Nasdaq 90 and I buy puts? On AAPL no less which was up over 10% today. Oh, and I made money.

AAPL was just going up non-stop, which I thought was slightly ridiculous and I knew there had to be some profit taking. I basically used some logic and watched the stock carefully as it got towards 170 which I assumed would be the top for the day. At the time that ended up being the case and I bought some puts. It then broke its uptrend and went sideways for a while, slightly down then broke down to 166. I was up 3,000 at that point but didn't sell, it came back up and I gave it every possibility to bounce off resistance of the upper channel and come back down, but it ended up breaking both horizontal and diagonal resistance, not to mention a round number of 167, so I exited and instead made 2,200, which was nice. It sucked letting the profits slip but until it broke the trend I am not to know maybe it was going to go down to 165 and I could make even more. Getting out ended up being correct as it stayed up and ended up at 170. Follow the chart!

GOOG was a different story, I followed the chart, I logically got in where I thought there would be a bottom, it was lagging most of the other tech stocks in terms of percentage gain too so I figured it would at least hit 655(it was at 645 at the time). It had support at 645, but that broke so I bailed and lost about 200. That's ok, I defined my lines and traded my plan, logic was right overall, but I just got in at about the wrong time, because it only broke that line for a little while then came back up and ended at 660.

Had I entered those AAPL calls yesterday, I would have been up about 5,000. But we know what happens when we start using "would have's". ;-)

If I trade at all tomorrow it will only be day trading again until Thursday morning after we have both PPI and CPI data. If they are lower than expected I think we may sustain the rally and keep going up. If they are higher than expected, that means the fed can't cut rates anymore and we will likely head back down for the time being. Some think this was just short covering, some of it probably was, others will look to that data as well.

Oh, I exited KSS and CVH just because I assumed a rally and did not want to give back any more profits. PPI could set the mood for tomorrow like Walmart and Goldman Sachs did today.

Monday, November 12, 2007

WTF Mate?

Yea, so today was an odd day. Nothing worked, my put positions went UP and my call postions went DOWN. MON swung from a decent profit to a large loss in a single day and at a time when the market was at one point up 100 points. WTF? KSS a retail store went up and stayed up even with the market finishing down. WTF?

It was even more depressing to get onto my laptop and have my Ameritrade account balance up from thursday and it was up 20% higher than it is now and I didn't break any rules in that time either. So, MON broke my trend and I exited as I should. My puts have not broken yet so I am still in those but they acted very odd.

Tech got smacked, AAPL and GOOG way down, AAPL hit 150 which is where I wanted to get into it, I tried and didn't get filled which may have been good. Jeff Kohler thinks tech is going to keep going down and that we should not be bargin hunting no matter how attractive prices have become(AAPL has lost 20% in the past week).

We broke through 1450 so we'll see if the next level holds. I think all eyes will be on CPI and PPI, if inflation is more mild than expectations we may find a bottom, if it is above expectations it could get ugly as people will know that the fed cannot cut rates and help out any more due to inflationary pressure. I likely won't add any positions until that data comes out, however I may do some day trading.

It's times like these I really wish I had a margin account so I could sell some options either exclusively or to help offset the cost of these higher options prices.

Even with the decline in money I still am confident in a full comeback by next April, plus I have other great things going on I am excited about(a girl). :)

We just have to stick to our plans but it does seem like an odd time Krystal commented that bull markets seem to work because things act more logically which I have to agree in my limited experience and Jeff has said the same.

Sunday, November 11, 2007

Looking Ahead

Well Friday wasn't a good day, all previous gains were erased by the market, and the movement I was concerned about in GOOG and AAPL at the end of the day ended up being a problem because we sold off into the close, not a good sign.

I had to exit 3 of my positions at larger than average losses(about 3%) all of them broke trend, so I exited. I have to stick to these rules if I want to come out ahead in the long run.

CMG proved the point again on why we follow rules, kept going down today so a loss I could have stopped at 2% ended up even bigger.

I now only have my 2 put positions on KSS and CVH, and my call on MON. Futures are looking bad at the moment for tomorrow. If we have another big sell off, I am going to be looking for a bottom around 1425, I don't see how we could go down much farther, but of course the market will determine that. At that point though I think many things will start looking very attractive, if we see the AAPL's and GOOG's it will probably entice some buying, because there is nothing different or wrong with those companies since last week yet they have given up over 10% of their value.

I'll be sitting and watching and waiting for a signal to get back long to at least play a bounce at this point I think.

We will see how it goes.

I had to exit 3 of my positions at larger than average losses(about 3%) all of them broke trend, so I exited. I have to stick to these rules if I want to come out ahead in the long run.

CMG proved the point again on why we follow rules, kept going down today so a loss I could have stopped at 2% ended up even bigger.

I now only have my 2 put positions on KSS and CVH, and my call on MON. Futures are looking bad at the moment for tomorrow. If we have another big sell off, I am going to be looking for a bottom around 1425, I don't see how we could go down much farther, but of course the market will determine that. At that point though I think many things will start looking very attractive, if we see the AAPL's and GOOG's it will probably entice some buying, because there is nothing different or wrong with those companies since last week yet they have given up over 10% of their value.

I'll be sitting and watching and waiting for a signal to get back long to at least play a bounce at this point I think.

We will see how it goes.

Thursday, November 8, 2007

Anatomy of a Trade

Good old GOOG. I wanted to detail a short term day trade I took today, which from a financial standpoint was unsuccessful, but from a trading standpoint a success. I saw google getting sold off and from the morning the futures didn't seem too bad, write downs were not as bad as expected and it seemed like we may sell off initially then start to recover(that was just my opinion due to the large sell off the day before). After GOOG started to stall around 715 and there were a few green ticks in a row I went long 5 contracts of the Nov 730. GOOG seems ideal for a day trade because you don't need to buy many contracts to make a decent amount of money, so commissions are kept to a minimum. So I get into the trade, all is going well, I am up 1500, Hooray!

Bernanke testified before congress today and did so about 40 min into the open. I should have assumed based on my stance and logic that he would not really favor cuts outright due to possible inflationary pressures, however I was still just watching the trend. If my uptrend broke I would exit. The problem was that it was such a violent reaction it blew through the trend, obviously the next technical level to hold would be 715 because stopping above that would technically still be a higher high. It went all the way down and through that. I immediately sold out, at the same price I bought so it cost me about 25 dollars in commisions, after at one point having an unrealized 1500. Oh well, as Warren Buffet says, rule number one is "don't lose money." Rule number two is "don't forget rule number one."

So, how was this a successful trade? I knew my risk, defined my exit, position sized correctly and most importantly followed my rules. Yes, the stock did retrace back up and I could have gotten out with a little profit if I held, but let's see what would have happened had I continued to hold throughout the day expecting a come back.

Today was crazy overall, Dow was down 200, and the Nasdaq was down 90 at one point! They rallied back, which I think had to be more than just short covering. I thought the sell off was exaggerated so I bought 1 contract again on GOOG at 700 assuming it could get a nice bounce tomorrow. Even though I am only down 90 dollars on it at this point I am somewhat concerned it didn't rally and hold better at the end of the day, I wanted it to finish strong, instead it bounced off of 700 as resistance right at the end. Same goes for AAPL, I am actually up on that, as I re-entered into it in my ROTH account close to 170. It too rallied back up to 180 but settled again at 175.

I sold out of my spy puts right at the open for a small profit assuming we had a decent day I wanted to be more delta neutral, that ended up being premature and I could have made some extra cash holding, but at the end of the day I think I would have made only slightly more than I did at the beginning so it wasn't all bad. That's the hard thing about holding those hedges on the index, even though it follows a pattern too I didn't want to be on the wrong side of that since I was much more delta negative with those puts. Overall on the day I was up a couple percent so I feel pretty decent.

CMG is a problem, and we know what can happen if we don't follow rules or make exceptions(ACH, CROX etc) it broke below 130. I however did not sell, it held 125, which looked to be good support AND it was on below average volume. I am still down only 1% on the options too and that is only because the spread is about a dollar wide right now. We will see what happens if we don't have a strong day tomorrow I will get out of it.

Whew, that was a long one. :-)

Wednesday, November 7, 2007

What A Difference A Day Makes

So, the day I assumed was coming has finally arrived. The S&P finally broke through the 1500 level fairly significantly on heavy volume and finished at 1475. This is significant because it marks a lower high and a lower low which could be the start of a downtrend and reversal but it is too early to know if that is the case.

I don't want to seem like I am flip flopping here or that I predicted it(I just looked at the chart), in fact it is almost strange. It's like the market doesn't think at all until the news happens, it doesn't exist until some company comes out with bad earnings or talks about write downs like GM or Morgan Stanley. It is very odd to me, maybe that is why trying to make predictions doesn't really matter because the market is simply functioning on current news and can change on an instant.

Anyways, enough speculating. Today was a down day for me, I gave back all the gains I made the previous day. I day traded GOOG to make a whopping 60 dollars(however it was good I exited on the break of trend otherwise I'd have lost a shit load, this is why we have a plan and watch the charts before taking a trade.) This put me in a tough spot because I didn't have any settled cash to get into more bearish of a position as it looked like we weren't going to rally.

So, I sold off some of my positions that were very close to my lines and had already lost me a decent amount of money anyways but not doing much, I sold my YUM and AKAM positions. I took these proceeds and bought 15 Dec 145 SPY puts as some insurance as we broke down again at the end of the day. This makes me balanced with 3 put plays and 3 call plays. However, I am now firmly biased to the down side with a -686 delta. I think this will be decent for a bit, we'll likely head down to 1450 in my opinion. If we don't stop there the next stop is the 1425 area.

Another trade I had was in my ROTH account, I bought AAPL however it then broke down below 190 which was my line, and I exited, which ended up being good as well because it broke even further and fell even more after hours. Again, more evidence why we make a plan and stick to it.

So I am flat over all after adding those new positions but I feel decently confident going into tomorrow with my current stance. The futures are down and the SPY fell further after hours so it's looking ugly for tomorrow if you are long, but so far my other long positions have not broken my lines. I will have some cash tomorrow to either add to my bearish stance or maybe take a day trade if it gets real bad tomorrow.

Hopefully everyone is setup ok for tomorrow, we'll see if I can make some money or at least be flat.

I don't want to seem like I am flip flopping here or that I predicted it(I just looked at the chart), in fact it is almost strange. It's like the market doesn't think at all until the news happens, it doesn't exist until some company comes out with bad earnings or talks about write downs like GM or Morgan Stanley. It is very odd to me, maybe that is why trying to make predictions doesn't really matter because the market is simply functioning on current news and can change on an instant.

Anyways, enough speculating. Today was a down day for me, I gave back all the gains I made the previous day. I day traded GOOG to make a whopping 60 dollars(however it was good I exited on the break of trend otherwise I'd have lost a shit load, this is why we have a plan and watch the charts before taking a trade.) This put me in a tough spot because I didn't have any settled cash to get into more bearish of a position as it looked like we weren't going to rally.

So, I sold off some of my positions that were very close to my lines and had already lost me a decent amount of money anyways but not doing much, I sold my YUM and AKAM positions. I took these proceeds and bought 15 Dec 145 SPY puts as some insurance as we broke down again at the end of the day. This makes me balanced with 3 put plays and 3 call plays. However, I am now firmly biased to the down side with a -686 delta. I think this will be decent for a bit, we'll likely head down to 1450 in my opinion. If we don't stop there the next stop is the 1425 area.

Another trade I had was in my ROTH account, I bought AAPL however it then broke down below 190 which was my line, and I exited, which ended up being good as well because it broke even further and fell even more after hours. Again, more evidence why we make a plan and stick to it.

So I am flat over all after adding those new positions but I feel decently confident going into tomorrow with my current stance. The futures are down and the SPY fell further after hours so it's looking ugly for tomorrow if you are long, but so far my other long positions have not broken my lines. I will have some cash tomorrow to either add to my bearish stance or maybe take a day trade if it gets real bad tomorrow.

Hopefully everyone is setup ok for tomorrow, we'll see if I can make some money or at least be flat.

Tuesday, November 6, 2007

Afterall, it is a bull market...

Well, after having listened to Jeff and Eric on the market cast they seem fairly certain we are headed higher and the market isn't very worried about he subprime and credit issues. This makes me feel better about my bullish bias in options, and the fact that I am looking to get into AAPL. This trade has me in a dilemma, the much lower risk entry is at 175, however it was basically trading in a range after gapping up in a flag type setup and it broke out today. It seems to me, since it has lagged GOOG and RIMM, that 200 is more likely than 175 with it breaking 190 today. It has the release of the iphone coming up in Europe as well.

It is a bull market but part of it seems wreckless to me, I would hope people aren't just forgetting what happened in late July as they suddenly realized subprime and housing was a problem.

Oh well, it isn't my job to anticipate the market, I just have to react and diversify to try and minimize how the market impacts my positions.

Speaking of positions, today my account gained back 3%, who would have thought following rules would have actually worked! Like I knew it did in the first place but decided to lose a lot of money to remind myself.

Anyways, all my positions were up or flat, even one put play worked today, as it should!

At the end of the day I got into TSL, it broke above some resistance on above average volume, so I got long, as both a play on china and solar, with FSLR blowing up this could be an alternate play.

Had I been watching AAPL during the day I would have likely been inclined to take it down, but I was working, lame. The problem now is I am almost fully invested with my whole account. This isn't really a problem for me, but from a standpoint of possibly needing some emergency put insurance I may have to hold off a little.

We'll see if we get a follow through up day tomorrow, not much economic data until next week and I'd like to see a good two day rally.

Happy Trading!

Monday, November 5, 2007

Back Again

Alright, well I am back again, with more positions, more diversification, low risk entries and smaller position sizing. Of course which one of my orders didn't get filled at the end of the day? FSLR, which promptly releases news after the bell and goes up. Such is life.

ACH continues to prove the point of why we cut our losses short, even if that means only getting the bid for an option to sell out at the end of the day. It gapped down big today, trading near 60, way below my break of 75 and the even more significant technical break of 70, I have no excuse for this. I am still too biased to the long side for my comfort, but I do have some money on the sidelines to buy some index puts if need be, which I think I will be needing soon as we keep retesting 1500 on the S&P I think its only a short time before we break it and down we go.

I did exit CROX last week, as I should have(but still much too late), which again proved to be the wise decision as it dropped even further today.

It's quite depressing to see all my options positions in the red, even if its only slightly on most, let's review the current and new positions.

ACH-I'm retarded, I'll be out of that tomorrow.

AKAM-exit with a break below 38, currently at 38.74 Target of 50 R:R=1:10

CMG-exit with a break below 130, currently at 130.94, Target of 150 R:R=1:19

CVH-exit with a break above 60, currently at 58.61, Target of 50 R:R=2:9

KSS-exit with a break above 52, currently at 50.93 Target of 45 R:R=1:5

MON-exit with a break below 92, currently at 93.39 Target 105 R:R=1:10

YUM-exit with a break below 38, currently at 38.51 Target of 45 R:R=1:6

So, I have my plan, now I just have to trade it, all of them fit my criteria of risk to reward, all are within the 2% risk tolerance.

I will look for good bearish entry positions as I may take on another one to help balance a bit more, but if there is a good bullish opportunity like on fslr again I will take it down because I think that stock will just keep going. I watching others like AAPL and GOOG as well for low risk entry points too.

I am weary of being too bullish right now because I think we will be going down eventually in the short term, force another cut in the rates as things get worse and then start to recover, who knows but with oil and gold at highs, the dollar at lows and a questionable credit market and terrible housing I don't think the market is global enough to keep rallying like this unless a couple things change. But of course my opinion means nothing and the market will do what it wants and likely knows better.

I have to give a shout out to Jeff Kohler for his watch list and giving me a heads up to some of these positions at good entry points. Hopefully they will help me pimp the market like Wayne Brady and I can say "I'm Rich Biatch!".

Saturday, November 3, 2007

Movin' On

Alright, so I screwed up, screwed myself over and lost a lot of money. That was yesterday, next week is a clean slate and I still have a good amount of capital to work with, albeit much less than before. I need to learn from the mistake, not repeat it and go with what works, position size correctly, diversify and define risk.

I have to remember my rule of being patient, not just for stock setups but in general, I got caught up again trying to make fast big money, which is no more than gambling. Gambling takes no skill and will make you lose in the long run.

I'm watching out for a break down of the 1500 level on the S&P 500, however we should be focused on individual stock plays in general. Time to research and be ready to jump in on monday.

Have a good weekend, I need a better sleep schedule. Goodnight.

I have to remember my rule of being patient, not just for stock setups but in general, I got caught up again trying to make fast big money, which is no more than gambling. Gambling takes no skill and will make you lose in the long run.

I'm watching out for a break down of the 1500 level on the S&P 500, however we should be focused on individual stock plays in general. Time to research and be ready to jump in on monday.

Have a good weekend, I need a better sleep schedule. Goodnight.

Thursday, November 1, 2007

Stupid Trades=Huge Loss

Well, I'm a fucking idiot.

I had a relapse today back into old risky ways. What happened is I tried to pick a bottom on CROX, expecting a snap back after such a severe sell off, and I was wrong, which would have been ok, but I was also not properly position sized.

At the open I saw the stock start to rally, which is what I was expecting so I hopped on board with 50 call contracts. The rally promptly stopped but not before I had paid up for the calls probably at the high of the day. I then sat around down about 1500, I wasn't too worried, I knew it would be volatile and had potential for a big pay off. I didn't have any defined risk, none, I didn't say "ok if I lose x amount I am out no matter what" or "if it breaks this level I am out". All of these were big mistakes, mistakes which currently have me still holding the calls over night into tomorrow and currently down 20% on my account. So, now I have set myself back again big time. The worst part is if I had entered my trades today a lot would have worked out. I am now over biased to the upside when my plan was to be equally balanced after today.

If there is a bad jobs report tomorrow the bull market could be over for a bit if we break below 1500 on the S&P and finish there.

So, what do I learn from this trade today? FOLLOW THE RULES! I had no defined risk, I didn't wait for a technical signal to determine if it even was a good time to get in, I was over position sized. In such a case I likely should have been emotional, but wasn't, it may have saved me some money this time. This was the anatomy of a very poor trade. Now, its back to the smart way of doing things and hopefully I can get back even by the end of the year, which may be a long shot.

Off to class, so I can stew in my failure.

Subscribe to:

Posts (Atom)