Wednesday, November 28, 2007

Frustration

I really can't dwell on it, there were lessons to learn and unfortunately it was very expensive to learn them. Jeff is very right, it is hard to trade in this market, if it is in fact a bear market.

Part of me wants to just sit out if it's a matter of capital preservation and its much easier to trade in a bull market. Although I have no idea when we would get into a bull market again(if we are in fact in a bear market). And I really want to learn to trade or at least survive in a bear market but I now feel undercapitalized again, which could be good because I'll take less risk but I will really have to be religious about my rules, as I should be anyways.

I can definitely see how some people can get fed up, I have drawn my account down 3 times now to this level, two other times were just because I was taking too much risk, this one partially that reason because of CROX, so I guess that explains it, however to keep giving that money back wears on you. I am by no means going to quit at all, it just means I have a lot more learning to do, but to learn I must trade, and survive to trade.

Today I tried to enter puts at the close on the SPY, Ameritrade was messing up and didn't fill the order for some reason so I cancelled and decided I would wait till tomorrow to take a position and day trade it. I can't believe these two rallies, as Jeff and Eric said, the sharpest rallies happen in the context of a bear market, its crazy to think though that the market can jump 5% on news of a possible rate cut, which in reality would do nothing for the present times. I am inclined to buy puts tomorrow if we do not break above 1475 on the S&P, I think if we start up again tomorrow we will give it back during the day, but if we start down we will continue down, again who knows I will have to watch the chart but that is what seems logical to me.

Bottom line is this volatility is tough, I wonder if in a bear market it's better to use a time stop, like give myself a time period to be right and if it doesn't happen within that given time period I exit. That partially seems wreckless because it could result in larger than 2% losses which is what I should still limit myself to.

Tomorrow is always another day to trade and make money back, but I could also lose, which is what I don't want to do so it is making it harder to be a mechanical trader.

Wednesday, November 21, 2007

Watch Out!

Sorry, I have slacked a bit lately. Yesterday was very frustrating. My original plan of buying on the open would have been very profitable, but I didn't do it so as GOOG got away from me I figured I would make money on the way back down as people took profits. I tried to pick a top a little too early. Again, my thought process was correct but I didn't give it enough time, although I thought I was following the chart, so when it looked like it was bouncing off 650, I exited at a 4% loss, had I held for another 20-30 mins I could have had a 8% gain assuming I got out reasonably near the bottom, which would have been my target actually.

All of that stuff is easy to say after the fact, do I go with logic and conviction or only the chart, or am I not reading the chart well enough? What was the difference between a profit and loss in that case?

The Dow was all over that day 140 gain then 100 loss, back to a 100 gain to finish up 50 I believe. Crazy volatility. Had I held till the end of the day I likely would have been in the same situation if not slightly worse then selling when I did anyways, I can't tell if that is good or not, I would have rather just made a profit regardless. So I erased my gain from the other day and a little bit more.

I am currently sitting out till after the weekend. GOOG and AAPL were holding up well on this big down day but I didn't want to be buying options just to have them decay until friday with light volume.

This could be big, the S&P broke below 1425, we are flat on the year now and a break below 1400 would signal a real break of the 5 year uptrend of the market. Preservation of capital will be big right now, I will have to go for small gains if I do, which could be challenging for me but if I want to be able to keep trading I have to. Jeff has said that in bear markets, everyone loses, its just a matter of who loses less. That's tough to already be down facing that, maybe I should sit out for a while. However, I also feel this will be a huge learning experience because it has been said that if you can trade through a bear market and survive you can trade through anything.

We'll see what happens. Have a Happy Thanksgiving, for those that celebrate it, even though it is a silly thing to celebrate, the holiday is nice.

Monday, November 19, 2007

Rebound?

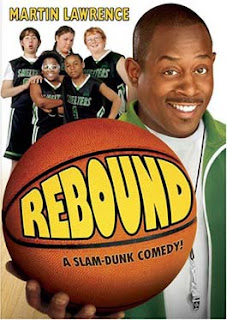

Damn Gina!

No, not Martin Lawrence's possibly funny family comedy(I haven't seen it), the stock market. Will we rebound here or continue down?

Alright, we technically shouldn't care, just react to market conditions but there are quite a few things to consider. We finished below 13,000 on the Dow, which is a fairly significant psychological number, which then argues that it is a technical level also. However this was on lower than average volume(due to the holiday shortened week) and historically this is a bullish week for the stock market going into the biggest shopping day of the year. The S&P has found support in the 1430 range and I referenced it earlier, so it would be a good sign for a decent bounce here, one of the reasons I feel like we will get a bounce tomorrow is HPQ's earnings came out and beat expectations and gave a good forecast and announced a stock buy back, so if nothing else tech may be the place to be if you are bullish. I will likely watch GOOG or AAPL tomorrow for a day trade opportunity.

Today, I took a trade on the SPY, bought some calls, but it broke trend shortly there after and I exited at a about a 200 dollar loss, not the biggest deal, less than 1% of my account, however losses still suck. Had I held till the end of the day I would have pretty much been where I was when I originally exited, but it was higher for a bit of the day.

I kind of want to go back and look but it seems like on down days we rally in the 1-2pm area, and on up days we could sell off at that time too, and then the trend usually continues afterwards if its a strong trend after 2pm. so people will start to lock in profits depending on if they are short or long, by covering or selling off in that time period.

I still struggle on taking anticipatory trades because those can be much more profitable because you will gain the gap up or gap down in a stock for the next day, but that is more risky, so at this point i'd rather go for a smaller move that is more likely since I am below even. If I were up decently, it would make more sense to take a bit more risk with pure profit, but at this point that is not the case.

The futures are up right now, but we'll see how they shape up tomorrow I am thinking we go higher on the day with the largest gainer being the Nasdaq. If the futures are up decently in the morning I may buy at the open.

Thursday, November 15, 2007

Day Off

I didn't do any trading today, I did watch some stocks today, and most of them went down. When we rallied the other day we went back up to the critical level of 1490 and could not break it. We now have a technical downtrend on the indices with the lower high and lower low. Is it a bear market? In the short term it seems it may be. With increased volatility and option prices generally higher I may stick to strictly day trading, or sitting on the sidelines since I cannot sell options at this point. I'll likely be looking for the next rally so I can get some puts on good looking setups.

I am hoping to do some trading tomorrow but may have to travel during market hours so we shall see.

Day Trading

Ok, so I figured I would detail what I am looking at during a possible day trade scenario. Krystal had a lot of good questions so I figured I would try and answer them with what I am looking at and doing. Again, I am not a professional nor a successful day trader but this is what I have observed.

Someone on Jeff's Option Addict blog asked if you could really apply the same type of chart set-ups to short term trades compared to intermediate. In theory, you should be able to apply technical analysis to any time frame and from what I have seen this is true, you just have to determine what you want to trade.

When I want to trade I want a stock that is liquid and has large ranges, I mean you could technically buy a lot more contracts(if you are trading options) and only go for a smaller move on a slower moving stock, but I'd rather pay less in commissions and get the same profit potential with a stock like GOOG or BIDU. I chose GOOG to look at.

How do I pick the option I am trading? Generally I will try to determine a reasonable move and pick an appropriate OTM option, I see no reason to not trade more OTM contracts simply because you are only holding for the day so time and volatility decay should be at a minimum. Always keep in mind your risk and know where you will exit, that will determine the amount of contracts I purchase.

To figure out where to get in determine your sentiment and watch the chart, if you were bearish on the day to begin with, which I was, you could buy puts at the open, but it'd probably be smarter to let the pattern form. You can see the down trend marked by "A". It is a classic example, lower highs and lower lows. So, if you entered at the top of "A" then you would exit where it broke the down trend.

It then entered a sideways channel 1 marked by "B". Again if you wanted to enter a trade, you could either take bounce or anticipatory trades at support and resistance, however you would likely want to wait for confirmation of a break either way then you would exit if it entered back in the channel or if it reached your target.

This chart is a 1-min 1 day chart(technically it shows 2 days I couldn't help it it is into tomorrow, sorry). But that is generally what I look at, or a 1-min 4 hour chart. We can see the downtrend marked by "C", you could have used that as a much shorter term trend trade, again proving that you should be able to use Technical Analysis on any time line. That trend ended up also breaking the lower channel support, you can then see the stalls and mini channels it formed marked by 2 and 3. Both followed rules of the downtrend not breaking back above, so technically you would still be in the trade if you entered after a break of the Channel C.

Downtrend "D" again, after a few lower highs and lower lows you can draw a trendline and use that. You would have gotten a lot more money out of the trade staying in till it broke right at the bottom but if you had another exit trigger you such as a target being reached then follow that. Again, have a plan and trade it and define your risk.

Hopefully that helps some and gives some insight on what I am thinking and what is possible on a short term basis. This may not work for some and I can't say it necessarily is suited to my style yet either but success should be possible just like any other timeline if you follow rules and the charts.

I didn't take those trades because I worked most of the day however I did watch them as they developed though.

Tomorrow I think will determine our direction, if we have bearish data we will go back down, if it's bullish we could break back above the all important 1490-1500 level on the S&P.

Tuesday, November 13, 2007

The Contrarian Trade

So the Dow is goes up 319, the Nasdaq 90 and I buy puts? On AAPL no less which was up over 10% today. Oh, and I made money.

AAPL was just going up non-stop, which I thought was slightly ridiculous and I knew there had to be some profit taking. I basically used some logic and watched the stock carefully as it got towards 170 which I assumed would be the top for the day. At the time that ended up being the case and I bought some puts. It then broke its uptrend and went sideways for a while, slightly down then broke down to 166. I was up 3,000 at that point but didn't sell, it came back up and I gave it every possibility to bounce off resistance of the upper channel and come back down, but it ended up breaking both horizontal and diagonal resistance, not to mention a round number of 167, so I exited and instead made 2,200, which was nice. It sucked letting the profits slip but until it broke the trend I am not to know maybe it was going to go down to 165 and I could make even more. Getting out ended up being correct as it stayed up and ended up at 170. Follow the chart!

GOOG was a different story, I followed the chart, I logically got in where I thought there would be a bottom, it was lagging most of the other tech stocks in terms of percentage gain too so I figured it would at least hit 655(it was at 645 at the time). It had support at 645, but that broke so I bailed and lost about 200. That's ok, I defined my lines and traded my plan, logic was right overall, but I just got in at about the wrong time, because it only broke that line for a little while then came back up and ended at 660.

Had I entered those AAPL calls yesterday, I would have been up about 5,000. But we know what happens when we start using "would have's". ;-)

If I trade at all tomorrow it will only be day trading again until Thursday morning after we have both PPI and CPI data. If they are lower than expected I think we may sustain the rally and keep going up. If they are higher than expected, that means the fed can't cut rates anymore and we will likely head back down for the time being. Some think this was just short covering, some of it probably was, others will look to that data as well.

Oh, I exited KSS and CVH just because I assumed a rally and did not want to give back any more profits. PPI could set the mood for tomorrow like Walmart and Goldman Sachs did today.

Monday, November 12, 2007

WTF Mate?

Yea, so today was an odd day. Nothing worked, my put positions went UP and my call postions went DOWN. MON swung from a decent profit to a large loss in a single day and at a time when the market was at one point up 100 points. WTF? KSS a retail store went up and stayed up even with the market finishing down. WTF?

It was even more depressing to get onto my laptop and have my Ameritrade account balance up from thursday and it was up 20% higher than it is now and I didn't break any rules in that time either. So, MON broke my trend and I exited as I should. My puts have not broken yet so I am still in those but they acted very odd.

Tech got smacked, AAPL and GOOG way down, AAPL hit 150 which is where I wanted to get into it, I tried and didn't get filled which may have been good. Jeff Kohler thinks tech is going to keep going down and that we should not be bargin hunting no matter how attractive prices have become(AAPL has lost 20% in the past week).

We broke through 1450 so we'll see if the next level holds. I think all eyes will be on CPI and PPI, if inflation is more mild than expectations we may find a bottom, if it is above expectations it could get ugly as people will know that the fed cannot cut rates and help out any more due to inflationary pressure. I likely won't add any positions until that data comes out, however I may do some day trading.

It's times like these I really wish I had a margin account so I could sell some options either exclusively or to help offset the cost of these higher options prices.

Even with the decline in money I still am confident in a full comeback by next April, plus I have other great things going on I am excited about(a girl). :)

We just have to stick to our plans but it does seem like an odd time Krystal commented that bull markets seem to work because things act more logically which I have to agree in my limited experience and Jeff has said the same.

Sunday, November 11, 2007

Looking Ahead

I had to exit 3 of my positions at larger than average losses(about 3%) all of them broke trend, so I exited. I have to stick to these rules if I want to come out ahead in the long run.

CMG proved the point again on why we follow rules, kept going down today so a loss I could have stopped at 2% ended up even bigger.

I now only have my 2 put positions on KSS and CVH, and my call on MON. Futures are looking bad at the moment for tomorrow. If we have another big sell off, I am going to be looking for a bottom around 1425, I don't see how we could go down much farther, but of course the market will determine that. At that point though I think many things will start looking very attractive, if we see the AAPL's and GOOG's it will probably entice some buying, because there is nothing different or wrong with those companies since last week yet they have given up over 10% of their value.

I'll be sitting and watching and waiting for a signal to get back long to at least play a bounce at this point I think.

We will see how it goes.

Thursday, November 8, 2007

Anatomy of a Trade

Good old GOOG. I wanted to detail a short term day trade I took today, which from a financial standpoint was unsuccessful, but from a trading standpoint a success. I saw google getting sold off and from the morning the futures didn't seem too bad, write downs were not as bad as expected and it seemed like we may sell off initially then start to recover(that was just my opinion due to the large sell off the day before). After GOOG started to stall around 715 and there were a few green ticks in a row I went long 5 contracts of the Nov 730. GOOG seems ideal for a day trade because you don't need to buy many contracts to make a decent amount of money, so commissions are kept to a minimum. So I get into the trade, all is going well, I am up 1500, Hooray!

Bernanke testified before congress today and did so about 40 min into the open. I should have assumed based on my stance and logic that he would not really favor cuts outright due to possible inflationary pressures, however I was still just watching the trend. If my uptrend broke I would exit. The problem was that it was such a violent reaction it blew through the trend, obviously the next technical level to hold would be 715 because stopping above that would technically still be a higher high. It went all the way down and through that. I immediately sold out, at the same price I bought so it cost me about 25 dollars in commisions, after at one point having an unrealized 1500. Oh well, as Warren Buffet says, rule number one is "don't lose money." Rule number two is "don't forget rule number one."

So, how was this a successful trade? I knew my risk, defined my exit, position sized correctly and most importantly followed my rules. Yes, the stock did retrace back up and I could have gotten out with a little profit if I held, but let's see what would have happened had I continued to hold throughout the day expecting a come back.

Today was crazy overall, Dow was down 200, and the Nasdaq was down 90 at one point! They rallied back, which I think had to be more than just short covering. I thought the sell off was exaggerated so I bought 1 contract again on GOOG at 700 assuming it could get a nice bounce tomorrow. Even though I am only down 90 dollars on it at this point I am somewhat concerned it didn't rally and hold better at the end of the day, I wanted it to finish strong, instead it bounced off of 700 as resistance right at the end. Same goes for AAPL, I am actually up on that, as I re-entered into it in my ROTH account close to 170. It too rallied back up to 180 but settled again at 175.

I sold out of my spy puts right at the open for a small profit assuming we had a decent day I wanted to be more delta neutral, that ended up being premature and I could have made some extra cash holding, but at the end of the day I think I would have made only slightly more than I did at the beginning so it wasn't all bad. That's the hard thing about holding those hedges on the index, even though it follows a pattern too I didn't want to be on the wrong side of that since I was much more delta negative with those puts. Overall on the day I was up a couple percent so I feel pretty decent.

CMG is a problem, and we know what can happen if we don't follow rules or make exceptions(ACH, CROX etc) it broke below 130. I however did not sell, it held 125, which looked to be good support AND it was on below average volume. I am still down only 1% on the options too and that is only because the spread is about a dollar wide right now. We will see what happens if we don't have a strong day tomorrow I will get out of it.

Whew, that was a long one. :-)

Wednesday, November 7, 2007

What A Difference A Day Makes

I don't want to seem like I am flip flopping here or that I predicted it(I just looked at the chart), in fact it is almost strange. It's like the market doesn't think at all until the news happens, it doesn't exist until some company comes out with bad earnings or talks about write downs like GM or Morgan Stanley. It is very odd to me, maybe that is why trying to make predictions doesn't really matter because the market is simply functioning on current news and can change on an instant.

Anyways, enough speculating. Today was a down day for me, I gave back all the gains I made the previous day. I day traded GOOG to make a whopping 60 dollars(however it was good I exited on the break of trend otherwise I'd have lost a shit load, this is why we have a plan and watch the charts before taking a trade.) This put me in a tough spot because I didn't have any settled cash to get into more bearish of a position as it looked like we weren't going to rally.

So, I sold off some of my positions that were very close to my lines and had already lost me a decent amount of money anyways but not doing much, I sold my YUM and AKAM positions. I took these proceeds and bought 15 Dec 145 SPY puts as some insurance as we broke down again at the end of the day. This makes me balanced with 3 put plays and 3 call plays. However, I am now firmly biased to the down side with a -686 delta. I think this will be decent for a bit, we'll likely head down to 1450 in my opinion. If we don't stop there the next stop is the 1425 area.

Another trade I had was in my ROTH account, I bought AAPL however it then broke down below 190 which was my line, and I exited, which ended up being good as well because it broke even further and fell even more after hours. Again, more evidence why we make a plan and stick to it.

So I am flat over all after adding those new positions but I feel decently confident going into tomorrow with my current stance. The futures are down and the SPY fell further after hours so it's looking ugly for tomorrow if you are long, but so far my other long positions have not broken my lines. I will have some cash tomorrow to either add to my bearish stance or maybe take a day trade if it gets real bad tomorrow.

Hopefully everyone is setup ok for tomorrow, we'll see if I can make some money or at least be flat.

Tuesday, November 6, 2007

Afterall, it is a bull market...

Well, after having listened to Jeff and Eric on the market cast they seem fairly certain we are headed higher and the market isn't very worried about he subprime and credit issues. This makes me feel better about my bullish bias in options, and the fact that I am looking to get into AAPL. This trade has me in a dilemma, the much lower risk entry is at 175, however it was basically trading in a range after gapping up in a flag type setup and it broke out today. It seems to me, since it has lagged GOOG and RIMM, that 200 is more likely than 175 with it breaking 190 today. It has the release of the iphone coming up in Europe as well.

It is a bull market but part of it seems wreckless to me, I would hope people aren't just forgetting what happened in late July as they suddenly realized subprime and housing was a problem.

Oh well, it isn't my job to anticipate the market, I just have to react and diversify to try and minimize how the market impacts my positions.

Speaking of positions, today my account gained back 3%, who would have thought following rules would have actually worked! Like I knew it did in the first place but decided to lose a lot of money to remind myself.

Anyways, all my positions were up or flat, even one put play worked today, as it should!

At the end of the day I got into TSL, it broke above some resistance on above average volume, so I got long, as both a play on china and solar, with FSLR blowing up this could be an alternate play.

Had I been watching AAPL during the day I would have likely been inclined to take it down, but I was working, lame. The problem now is I am almost fully invested with my whole account. This isn't really a problem for me, but from a standpoint of possibly needing some emergency put insurance I may have to hold off a little.

We'll see if we get a follow through up day tomorrow, not much economic data until next week and I'd like to see a good two day rally.

Happy Trading!

Monday, November 5, 2007

Back Again

Alright, well I am back again, with more positions, more diversification, low risk entries and smaller position sizing. Of course which one of my orders didn't get filled at the end of the day? FSLR, which promptly releases news after the bell and goes up. Such is life.

ACH continues to prove the point of why we cut our losses short, even if that means only getting the bid for an option to sell out at the end of the day. It gapped down big today, trading near 60, way below my break of 75 and the even more significant technical break of 70, I have no excuse for this. I am still too biased to the long side for my comfort, but I do have some money on the sidelines to buy some index puts if need be, which I think I will be needing soon as we keep retesting 1500 on the S&P I think its only a short time before we break it and down we go.

I did exit CROX last week, as I should have(but still much too late), which again proved to be the wise decision as it dropped even further today.

It's quite depressing to see all my options positions in the red, even if its only slightly on most, let's review the current and new positions.

ACH-I'm retarded, I'll be out of that tomorrow.

AKAM-exit with a break below 38, currently at 38.74 Target of 50 R:R=1:10

CMG-exit with a break below 130, currently at 130.94, Target of 150 R:R=1:19

CVH-exit with a break above 60, currently at 58.61, Target of 50 R:R=2:9

KSS-exit with a break above 52, currently at 50.93 Target of 45 R:R=1:5

MON-exit with a break below 92, currently at 93.39 Target 105 R:R=1:10

YUM-exit with a break below 38, currently at 38.51 Target of 45 R:R=1:6

So, I have my plan, now I just have to trade it, all of them fit my criteria of risk to reward, all are within the 2% risk tolerance.

I will look for good bearish entry positions as I may take on another one to help balance a bit more, but if there is a good bullish opportunity like on fslr again I will take it down because I think that stock will just keep going. I watching others like AAPL and GOOG as well for low risk entry points too.

I am weary of being too bullish right now because I think we will be going down eventually in the short term, force another cut in the rates as things get worse and then start to recover, who knows but with oil and gold at highs, the dollar at lows and a questionable credit market and terrible housing I don't think the market is global enough to keep rallying like this unless a couple things change. But of course my opinion means nothing and the market will do what it wants and likely knows better.

I have to give a shout out to Jeff Kohler for his watch list and giving me a heads up to some of these positions at good entry points. Hopefully they will help me pimp the market like Wayne Brady and I can say "I'm Rich Biatch!".

Saturday, November 3, 2007

Movin' On

I have to remember my rule of being patient, not just for stock setups but in general, I got caught up again trying to make fast big money, which is no more than gambling. Gambling takes no skill and will make you lose in the long run.

I'm watching out for a break down of the 1500 level on the S&P 500, however we should be focused on individual stock plays in general. Time to research and be ready to jump in on monday.

Have a good weekend, I need a better sleep schedule. Goodnight.

Thursday, November 1, 2007

Stupid Trades=Huge Loss

Well, I'm a fucking idiot.

I had a relapse today back into old risky ways. What happened is I tried to pick a bottom on CROX, expecting a snap back after such a severe sell off, and I was wrong, which would have been ok, but I was also not properly position sized.

At the open I saw the stock start to rally, which is what I was expecting so I hopped on board with 50 call contracts. The rally promptly stopped but not before I had paid up for the calls probably at the high of the day. I then sat around down about 1500, I wasn't too worried, I knew it would be volatile and had potential for a big pay off. I didn't have any defined risk, none, I didn't say "ok if I lose x amount I am out no matter what" or "if it breaks this level I am out". All of these were big mistakes, mistakes which currently have me still holding the calls over night into tomorrow and currently down 20% on my account. So, now I have set myself back again big time. The worst part is if I had entered my trades today a lot would have worked out. I am now over biased to the upside when my plan was to be equally balanced after today.

If there is a bad jobs report tomorrow the bull market could be over for a bit if we break below 1500 on the S&P and finish there.

So, what do I learn from this trade today? FOLLOW THE RULES! I had no defined risk, I didn't wait for a technical signal to determine if it even was a good time to get in, I was over position sized. In such a case I likely should have been emotional, but wasn't, it may have saved me some money this time. This was the anatomy of a very poor trade. Now, its back to the smart way of doing things and hopefully I can get back even by the end of the year, which may be a long shot.

Off to class, so I can stew in my failure.

Wednesday, October 31, 2007

Happy Halloween

After they announced the cut I sold my 25 SPY contracts. This initially was a premature move because things moved down and I could have actually made an extra 250, instead I only lost 100, which I will gladly spend for some insurance.

I did lose 1,000 on the day though, which is somewhat disappointing, however I was not nervous or stressed going into the announcement at all, I was just there to make adjustments as needed. This is how I know I was in a decent position, and had it turned out poorly and I wasn't hedged it would have been much worse.

So for tomorrow I have found some trades I will take that have low risk entries, I looked at Jeff Kohler's watch list which was great and took some bearish and bullish trade ideas from there as well as a few I am watching so I will be getting into a few trades tomorrow, which I will discuss at that time.

CROX got hammered after hours due to earnings projections apparently not being up to par, which could be a good day trade opportunity as usually it will snap back.

I am excited for tomorrow with all the possibilities, could see some profit taking, hopefully on some bullish trades I can get some better entry points. Now its time to celebrate Halloween.

Balance Pays Off

I have to apologize for the late posting, I just got done watching American Gangster(yea I am cool because it isn't out yet and I have it).

Anyways, today we had a down day ahead of the fed announcement tomorrow at 2:15. The nice thing was that my account was actually up on the day and I am back even from where I was before the BIDU trade. The SPY puts ended up being a big help, while AKAM looks like it has started its movement, as well as YUM. ACH is the laggard which actually lost me 1,100 on the day, I couldn't exit either because at the end of the day at work someone came in right before market close and before I could exit. Damn people.... :-)

There were a lot of plays I wanted to take ahead of the announcement, mainly bearish plays, however many of them involved banks, which would benefit from a cut and right away I would be out money. The bullish plays also, like on AAPL which looks to have broken out of its flag around 185 would have been great too, but if they don't cut tomorrow it will likely get sold off and I can get in at a better price.

So, I am sitting tight realizing I will have options either way and plenty of opportunities after the announcement and the fed influences the market direction. I feel like they will cut the .25% however part of me feels like they may hold steady simply because rising oil and the falling dollar and rising commodities can't be over looked forever.

If they hold steady I will likely add to my SPY puts because I think the market will sell off because it will be due to inflationary pressure and not strong economics. If they cut we may see a slight relief rally and then a focus on earnings again and I'll likely get into my bearish plays and bullish plays as normal.

We shall see what happens. Hopefully my balanced approach will help me be poised to kick the markets ass regardless, such as my friend the Karate Kid.

Monday, October 29, 2007

Hedged for Fed Day

So the much anticipated Fed decision day looms on Weds. What will they do? Cut .25% cut .5%, do nothing?

My goal is to get to a point where I don't care about what happens because I am diversified enough and almost neutral to the market. This is still very much a work in progress because I am still learning the most effective way to be neutral. I took a simple approach which I think is correct in terms of being delta neutral.

Before we get to that though, I'll detail my unsuccessful BIDU trade. I saw BIDU up in the pre-market about 3.5%, on a day that would likely have little volume and not much market movement I figured this would be more than most positions and would get sold off down to 2 or 1%. So I watched for a change in direction after the open, it presented itself, I got in with 10 put contracts (again lagged a little and had to replace my order still haven't looked into trade triggers nor do I know if I can trust them). I get in after it broke below support, it then reverses and bounces back up to a previous resistance line, so at that point it isn't broken, it come back down and I am back even.

After a little more range trading it goes up and then breaks resistance again where this time I exited at a $700 loss. This was good in that it fit my risk criteria and if it broke down to where I projected I would have made much more than I lost, So I got out with less than a 2% loss, and the trend was broken, however the bad part, is I lost money. The stock traded in a range ALL day, where at any given time I would have probably been up 500, or down 500 but still in the range. at the end of the day it ended up near highs, so I avoided a larger loss by exiting when my trend line was broken originally, even though it did re-enter later on.

I took on a few new positions. some Jan 40 calls on AKAM, it looks like it is going to be reversing and broke above 38 which was resistance and should hopefully fill a gap to 50, which is my target price. A close back below 38 will be a signal to exit. I got back into ACH, who now apparently reportered earnings, I saw it being bought and it got above 75 which it was having trouble doing before. I got in when it was above 76 and it came all the way back down but did manage to finish above 75 which is my line.

So, now I have 3 bullish plays going into the Fed rate decision, the fed funds futures point to almost a guaranteed .25 cut, but again we never know. I decided to hedge my position with some SPY puts. I currently hold 25 total long calls, I estimated an average delta of .5 each so lets say I have a total of 12.5 delta positive on those positions. I wanted to counter that, but I am still overall bullish so I went out of the money front month(since I probably won't hold them for more than a day anyways). I bought 25 152 puts each with a delta of -.27. That positions gives me a -6.75 delta, for an overall positive 5.75. This is obviously still fairly bullish, but much better than a complete long position in my opinion. Plus I am testing the waters to see how it works out.

AAPL couldn't finish above 185, RIMM is looking appealing though, AZO was brought to my attention of an Inverse Head and Shoulders pattern, so a break above 125 would confirm but it touched 125 and finished under 124, no go yet. I am still looking for relative weakness plays that I like the entry points on because a hedge will help me in this situation but not in general.

Have to say thanks to Brett Atlas for pointing out both YUM and AKAM originally.

Also, I have to say I think Bernanke so far is doing a good job and I like him better than greenspan in my limited knowledge, but I just couldn't resist putting that pic up once I found it. :-)

Saturday, October 27, 2007

Trade Costs

Ok, so I have been behind on posting, I apologize(which I am likely doing so mostly to myself).

So, we left off I was long the Q's, that following day before earnings I was down flirting with my loss limit during the day, but sure enough at the end of the day I was only down less than 1%, well within my risk tolerance. I figured MSFT would post good earnings and lift the market and particularly the Nasdaq. This did in fact happen, however the gap up only gained me 500 initially, however this was on 20 contracts. That decayed however so I got out even as I figured that is as high as we would go for the day and it would just sit from there and I'd lose money so I sold at break even and decided to buy puts on the Q's instead. I bought 100 contracts and the options gained 10 cents at the time up 1,000. The stock started to stop and trended sideways, then started back up, it broke the down trend line so I then exited, after the previous experiences I am trying to be more patient and wait for confirmation of broken trade before exited rather then setting a sell limit.

This time that worked against me however I did get out with 500 gain. However, lets take a closer look. That 500 gain was actually only 330. Ameritrade charged 9.99 per trade and .75 per contract. Which means they took 170 dollars home on my work and in the proces took 1/3 of my profit. Obviously 330 is nothing to be upset about but I could have exited multiple times at different prices but Ameritrade also only allows me to trade options in 5 cent

increments. So what could have been a 800 dollar gain is cut even smaller.

This is getting me thinking about different brokers because some places charge significantly less money and if I am trading more that will mean more profit and less loss in the long run for me. If anyone has good suggestions for low priced option brokers please let me know. One guy I know said there is a place that charges 9.99 for 50 contracts, which would have let me keep way more of my profit. My only fear is going with something less reliable and reputable, so I'll have to do some research.

Right now I am only long 10 Jan calls on YUM, waiting on my other two favorites GOOG and AAPL to pull back, that have had trouble getting over 675 and 185 as of late so that may be a price to watch. I have a few bearish plays on the radar thanks to Jeff and the other OA's but haven't decided on which to go with. Time for good old fashioned research.

Wednesday, October 24, 2007

Lesson of the Day: Trust the Chart

So, today was partially frustrating. but where there is frustration there is likely a lesson to be learned. The lesson today, always trust the chart and logic.

My SPY calls lost about 500 of value overnight so I sold at the open anticipating a big down day due to both Amazon and Merril Lynch earnings. This ended up being correct overall, with the S&P rallying only at the end of the day and the options barely getting back to where I sold, obviously I don't know if that will happen so I sold.

So back to the issue. Today I was bearish on all of tech with amazon coming out, combined with such a large run up the previous day I assumed there would be profit taking. I was watching AAPL and GOOG for some price action to exploit to the downside since that seemed like the logical path of least resistance for the day.

The above picture is of AAPL at the begininning of the day, forming a PERFECT ascending triangle, with support at 185, if this broke I assumed we would go down decently partly because the pattern shows a 2 point move, which was then my target of 183. So I sat there waiting for the break with my order filled out on Ameritrade waiting to hit "submit". It breaks and the option price goes up above what I currently had, I have to scramble to change and as I do it starts to break hard and I sit there and don't want to chase it. I could have entered about 1 min before the break for my limit price but didn't take the anticipatory trade. As you can see once that support broke it moved even farther than I thought going all the way down to 179. Even waiting for my original target I would have made a quick 5,000 on my 50 contracts.

In retrospect, I should have take the anticipatory trade, the pattenr was setting up perfect, I had a bearish stance and I would exit if it moved out of the triangle so risk was defined. Once it broke and I didn't want to chase it I think I let emotions of ego get to me, not wanting to break my "winning streak" being 5/5, which is stupid. Obviously that is great but I am going to be wrong many times, it is just a matter of limiting those losses. So as a result I missed that trade and a similar trade to get into AAPL calls as I figured there would be a bounce off 180 but again my order lagged the option price movement and I ended up sitting out all day.

The only positives are I didn't lose money today, which is one of the first things you want to try and achieve, as well as I kept in mind that there will always be other opportunities and didn't chase trades, and I got to see how short term patterns and price action again can be used to my advantage.

After the big recovery at the end of the day, I bought 20 calls of the Nov 52 QQQQ's in anticipation of MSFT earnings. This ended up being wrong because they report after the close tomorrow, however almost all the tech names that reported after the close were positive and Microsoft announced a deal with Facebook. In General, I think tech is the place to be in this economic climate and if we can manage to finally break and finish over 2800 that clears the way for all new highs. So far the Q's are up in afterhours so hopefully it will follow through tomorrow.

We shall see...

Tuesday, October 23, 2007

Day After Day Trading?

So, Apple opened up at about 188, I assumed this would get sold heavily upon open so I sold my single contract I had held as soon as I could. I sold the option at 19.60, remember the previous close price was about 12.3, the stock gapped 14 dollars which was all intrinsic value at this point, and I only gained 7 dollars on my option, just to further point out the IV decay(had there been no decay I should have gained all 14 dollars).

So I decided to day trade again, I assumed there would be a hard sell off, which happened, it dropped from 188 down to about 183 in short time as people locked in their gains, from previous experience this is usually then countered with a snap back to the hard sell off. So I waited until the down trend broke went long 25 Nov 190 calls, this promptly made me another 1,250. Again, I got out fast and left money on the table, but until I am more comfortable and have more experience I will go for a quick 3% gain any day.

I got back in later as the stock traded down again to 185, which I assumed would be support due to the psychological number and a few other things, obviously the chart confirmed this and I waited for it to start turning up, I assumed we would have a market rally after the sell off in the middle of the day, so I watched the Dow and Nasdaq also to try and get an indication of it helping the upward move. I bought back in and it sat right at my line of support, fluctuated from down 250 to up 250, after 10 mins of the rally not materializing like I thought I bailed out with only a $100 gain which is better than a loss. Had I been more patient I could have made another nice gain, I was just too impatient.

After the second Apple trade I figured I would go for some index ETF options, I chose the SPY's, which turned out to be less profitable than the QQQQ's would have been since everything tech related was up huge. I chose a point where at the time the S&P was about 1507, which it had bounced off 1500 the previous day. I got long 20 contracts of SPY Nov 152's, which at the end of the day were shaping up nicely with a 1,000 unrealized gain. I had considered selling out but figured with Amazon's earnings we could have a follow through day.

Unfortunately it's looking like at the open I'll be giving back half those gains, Amazon beat but apparently didn't validate the high PE with concerns over margins and the stock sold off and gave up the 10 dollar gain it had during the day. Which then caused many of the other large tech gainers to sell after hours, so that will likely weigh on the markets tomorrow and people will lock in the huge gains today in names like GOOG and BIDU, which may be an opportunity to make some money on some puts, I'll see what it seems like tomorrow.

So, overall today I managed 5% realized gains, which I am happy about.

I am thinking earnings may present a new opportunity, those that report earnings the day after trade usually much higher volume and ranges which could be exploited in day trading front month options. So far it has worked to my advanatage being 5/5(of course we know stating that will jinx me tomorrow :-))

I listened to Jeff Kohler's free advanced option's open house which was very interesting, it is getting me interested in spread trades, unfortunately I think it will require a margin account which I do not have and may not be able to get. I'll have to do some more research and see what I can do.

Let's see if I can make money on a down day too....

Monday, October 22, 2007

An Apple a Day Keeps Losses Away

So, another stock reporting earnings and another stock I had options on going into them. Apple released after the bell, posting a 1.01 EPS and 6.22 Billion in revenue, simply awesome, they even raised guidance for next quarter which is unheard of for them.

So, of course the whole dilemma came up about what to do going into earnings. I decided to take the conservative approach this time. I hadn't done analysis like last time so even though I expected they would beat I didn't know if it would be good enough for expectations. I was holding 5 contracts with about 1,300 in profit. I sold 4 early in the day when the stock nearly reached my original target of 175, which proved to be almost the most I would get for them since the option never got back to where I sold which was 12.60.

Of course they beat huge and the stock is up 12 dollars in after hours. I could kick myself(which I do a little) however in the long run selling most of them will likely be in my favor because we honestly can't predict the future, they may have earned only .95 and that caused a sell off, who knows. I locked in my gains, and let 1 ride since that was basically all profit. Tomorrow according to the CBOE calculator I should have about 500 more in profit if the price holds, sure I could have 2500, but I could also have lost money. The Implied Volatility COLLAPSED from 54 down to 9! So I am lucky to even come out ahead at all, if I was holding OTM options I likely would have lost money or at most broke even.

Now options are actually underpriced and a better value. I feel like Apple could pull back here because it has had a huge run, so I may wait for a better entry point.

On to my other trades, the morning opened ugly, things gapped down then continued down for the first half hour and then started to recover. I sold out of my SLB and DRYS options as I was already way below my line. Was this smart or should I have waited? I think what matters is consistency, in this situation, I sold SLB and it ended up down further, I sold DRYS and it ended up gained a lot back and then some(still finished below 120 which was my line)

Had I kept DRYS I would have made back another 600.

Had I kept SLB I would have lost another 800.

As we can see in this situation it worked to my benefit as I am up 200 vs where I would have been had I sold at the end of the day.

I think the Nasdaq will be strong tomorrow due to Apple so I'll have to watch some positions, most I lost on likely will have recovered but I have to assume they wouldn't have. And overall I should basically be even compared to the big down day on friday, which is the first thing you need to do is not lose money.

Saturday, October 20, 2007

I Saw Red

Well, pretty ugly day today, Dow down 366 Nasdaq down 74 OUCH!

Well, GOOG ended up gapping up to 558, that should have then added 18 dollars of intrinsic value to my option and where did it open? Why, 3 dollars higher than yesterday... This illustrates the collapse of IV clearly those calls were way over priced. I luckily got out though with a 100 gain.

I was not satisfied with that and figured on such a day it would be great to do some day trading the front month contract. I watched and waited and bought after GOOG had put in a pretty good bottom at 546, bought 50 contracts at 1.60, this was also during the middle of the day and we were down at 230, at the time i figured there would be a slight rally also, it did indeed go up as expected, I didn't want to get greedy so I set my sell limit at 2.00. A quick 2,000. Then I got to watch it go all the way up to where I thought and the calls were worth 3.40, oops could have had a quick 8k out of GOOG, however I set my targets, plus that is a large position and didn't want to hold it too long. I then got into another 10 contracts later and made another 500. Overall, made an extra 2,300.

That extra 2,300 was very helpful because after that I went shopping for options, BIG mistake(today at least), at about 1pm. New rule, on a down day like today, always wait till the end of the day to see if I should still get in. What happened is I got in at my exits, and they sat around them until the end of the day and most significantly broke so I had to exit again immediately, which I am glad I followed rules. Due to some circumstances Ameritrade fucked up and I couldn't exit some trades. So, at the end of the day, I still ended down 1,200 largely due to getting into those new options.

I am desperately needing to diversify as the market seems to be wavering, if we break 1500 on the S&P I think we go down, and if the Fed holds in october, people will likely sell quite a bit.

lessons of the day: Wait till the end of the day on big down days to take trades(and in general), DIVERSIFY, calls and puts.

Ben

Friday, October 19, 2007

Holding Over Earnings: My Opinion

Ok, so as long as I have traded and watched investment shows and been part of trading communities this question always comes up. "do I hold over earnings?" That depends. In my opinion, earnings speculation can be fairly profitable, it can also lose you money. First lets remember the lesson I learned the hard way.

If you are holding OTM options going into earnings and plan to hold, at least switch to ATM or ITM options.

Even holding over earnings you are going to want to estimate your risk and keep it at 2%.

Here is what I do to decide if I will hold, depending on which way I think the stock will go, I will see what has it historically done? Does it run up into earnings and then sell off on good reports, does it stay fairly flat then gap up?

Obviously, in any case you want to increase your probability by looking at those things. See how many times has the stock beaten lately if you are bullish, does it usually beat in the quarter they are about to report? Is it logical that the stock should do well, has it been talked about lately on how well its doing(or how badly if you are bearish).

What is even better is if you can quantify yourself. Like I did with AAPL, however that may not always be doable. Here is what I did, this was all from either internet statistics and logical guessing based on past performance. You can see I was slightly off, but much closer than the analyst estimates.

Apple Q3 earnings estimate

Previous 2006 Q3 notebook sales 798,000

Reported notebook growth compared to year ago, 65%

798,000 x 1.65=1,316,700

Average notebook cost 1,400

1843380000 x .3=553014000

Assuming 30% margin(previous margins)

Desktop sales

Previous 2006 Q3= 529,000

Assuming slight drop in desktop sales 500,000

Average cost 1,300

650,000,000 x 30% = 195,000,000 .

Iphone Q3 sales 500,000

Average price 580

Ipod Q3

Previous 2006 Q3 sales 8,111,000 which was 32% over 2005

Assuming a drop in growth year over year due to iphone lets say 25% growth

8,111,000 x 1.25 = 10,139,000

Average cost assumption 200 dollars

Supposed comments that margins on ipods are “above 20%”

Let’s assume only 20% margins

10,139,000x200= 2,027,800,000

Other music related revenue assumptions

Previous year Q3 457,000,000

Q3 2007 500,000,000

Peripherals

236,000,000

Software, service and other sales

350,000,000

Margins unknown

Total Revenue Estimate

$5,897,180,000

Prediction is for 14.6% profit(equal to previous quarter profit level)

Using that prediction

Profit= 860,988,280

Total EPS= .995 for 864, 950,000 outstanding shares

So, getting all of this is fine what will the stock reaction be? You honestly don't know but using the above things to your advantage can give you an idea, I also compare to what is currently happening. On good earnings and guidance stocks were gapping up approx 10% from similar companies, so I figured 7%-10% move was possible. I was right, but like I said hadn't learned about IV decay after earnings, so I screwed myself.

For GOOG, I figured we would get a run up to 640, I had bought the 640's hoping it would end up in the money before, but it was ATM, I assumed we would get a move to 650 on good earnings at least, being a round psychological number and validating current PE. This move would be hopefully good enough to offset IV decay and then some, it may not have worked out how I planned but I may be able to break even or take a slight loss which is ok because the money making potential was decent and if you can take a few small losses or break evens and get a good gap up(like on ISRG) you'll do fine.

So, if everything checks out I'll hold, a small position now over earnings, if I am unsure I won't hold.

Thursday, October 18, 2007

GOOG earnings

Well, GOOG reported earnings after the close today, the stock closed right at the money for my option and I was up slightly on it so I figured I would hold expecting good results. Good results came, stock initially moved down, then up to 650, then fell back down to 643.5. I was hoping for more.... At this point I am hoping to get out of it even, even though I think it is going higher in the long run, Oil hit $90/barrel afterhours which I think will weigh on the market a lot tomorrow. I will watch it tomorrow and if it is looking like it won't rally any during the day I will likely exit.

Now on to the previous dilemma. FCX, I sold out of this for an 800 loss, which is right at my 2% level. Of course then on the marketcast tonight Jeff says FCX is a great play to be in, oh well. I made a decision and I will see what happens, had I held till close I could have gained another 150 back, but I again had to leave before the close.

ACH, which had inexplicably ran up 10 dollars yesterday(well I think the explanation had to do with China and hong kong exchanging shares) pulled all the way back to 80 dollars, which is where it was having trouble breaking before. I took down 5 contracts a little under 81, with a target of back to its high, possibly take it to the century mark. if it breaks that 80 mark, it doesn't have much support until 70 so I will exit if 80 is broken. a 1:9 risk/reward, which I would always take.

I still want to get some put plays going, maybe on the XHB or some banks, most are already low priced though, JCG could be good but its not very liquid.

Here is how the account stands at the close with my options:

FCX(closed) -800

ACH +250

AAPL +1,375

GOOG +60

Wednesday, October 17, 2007

A Dilemma...

Well, a little update on the positions.

AAPL Nov 170 calls +1,375 (good)

GOOG Nov 640 calls -90 (eh, took a 6 dollar move over where i bought at to get back to about even)

FCX Nov 120 calls -1,100 (Terrible)

Ok, so as we can see, 2/3 somewhat working out, however FCX is down 1,100, which is over my 2% risk I want to limit losses to.

As we went into the close there was a rally, which was good, I spent the last hour before close in the car though, at the the time I was down about 850 on the call, just over my limit but it still wasn't the end of the day.

So here comes the dilemma, I got into FCX at 115, wanting to play the momentum going into earnings I was giving it a 2% loss forgiveness. So now, I am sitting at almost a 3% loss, however, FCX has not broken recent support at 110, in the meantime my call loses time value and volatility. So what do I do? Hold until it breaks 110 and possibly lose more than even the 3% I have already lost? Or sell out now and assume it continues down but limit my loss to only 3%.

I have yet to decide, what I should have done in retro spect is wait for a pull back to this support level and then get in, so there is a learning experience. I am less inclined to sell because the actual trend hasn't technically broken combined with stocks normally going up before earnings, but I am losing more than my wanted 2%.

The good news is I am up 150 over when I started the positions, however I would be 300 richer had I cut the loss exactly at 2%.

I'll see how the day shapes up tomorrow. If anyone has input on suggestions that has more experience let me know.

Monday, October 15, 2007

Trading Rules

Here are my rules I have come up with so far. Most of these concepts are adapted from Jeff Kohler's blog and tailored to fit my trading style. I will discuss the rules under the list.

1. Plan the trade, trade the plan. Determine entry point, exit point, price target and time needed before entering the trade.

2. Be patient, wait for low risk entry points, these higher probability trades will be worth waiting for.

3. Only risk 1-2% capital per trade(as account grows position size will naturally grow as well).

4. There will always be more opportunities, if a trade is missed wait for another entry point or better trade altogether.

5. Take trades that are the logical easy money, that you have conviction about.

6. Do NOT trade in the first hour unless absolutely necessary.

7. Do not put on a full position unless it is a very low risk entry point and risk is clearly defined.

8. The trend is your friend, do not go against it unless a pattern confirms reversal.

9. Cut losses short when confirming break of support, let winners run unless chart or news of company says otherwise.

10. Trade(in general unless situation determines otherwise) one strike out of the money options with appropriate time for target.

As a trader all we should really be concerned about is probability. How can we gain an edge over the market in the long term? We do this by only getting into high probabilty situations with defined risk. If we create a plan before we enter a trade, emotion should be essentially eliminated. This is because we already know how much we may lose and it is within our risk tolerance. If we know we are only risking 2% of our capital and we can rest easy knowing that is likely all we will lose.

How can we increase our probability of success?

We cut our losses at 2% always and let our winning trades go until they reach our targets, unless they signal an early exit or break of trend.

We only choose trades with higher probability, trade with the trend, wait for confirmation before taking trades, and trade relative strength or weakness stocks.

We diversify our portfolio with multiple higher probability low risk trades, with both put and calls plays and hedges. For example if we have 10 positions on at once that gives us a better chance of being right at any given time.

ALWAYS follow your rules! The purpose of these rules is to be able to trade almost mechanically without emotion. Most people fail because they hope when they should fear and vice versa, since we already have a plan and rules we don't need hope or fear, we simply follow our rules knowing probability is in our favor in the long run.

These are my rules, feel free to use them or change them to make them your own, but make sure you take responsibility for your own trades.

As I learn and adapt these rules will be updated as I feel appropriate.

Back in the Game

So after selling out Friday somewhat prematurely, I was lucky enough to get pull backs today in many of the current stocks of interest which ended up working in my favor this time, mostly AAPL, GOOG, POT, DRYS, ISRG, FCX, BIDU, FSLR. These are stocks that have been discussed over on Option Addicts. Those are all currently bullish plays and patterns and I need to put on some bearish plays, I think possibly now more than ever.

After today I am slightly concerned, although looking at a 3 month chart the S&P and Nasdaq are sitting at what appears to be diagonal support, so I'll have to watch that closely, I may buy a few puts on the S&P as insurance. Jeff discussed hedging with gold and oil which I am looking into as well.

I took long calls in AAPL, GOOG, and FCX

If I get a close significantly below 165 on AAPL I will exit, I got in with the stock at 165.8, looking for it to get back up to 170, if it doesn't break 170 and close above the next time it gets to it I will likely exit since it hasn't been able to a couple times now however if it does I will stay in till 175. So my risk/reward ratio is approximately 1:5 at worst, very good. In general I will try and stay above a 1:4 ratio, lowest is 1:3. 165 in apple has been recent short term support, I think more significant support would be found at 150. In this case I am partially playing the run up into earnings which happens on Oct 22nd. If my options get into the money(Nov 170's) then I will sell part of the position and hold part over earnings. I am currently up slightly on these calls(+275) on 5 contracts. The stock was bought fairly heavily going into close, which is encouraging, I am hoping it was institutional buying and not short covering.

GOOG, I bought 1 contract of 640 november call, again a play on likely run up into earnings and increased Implied Volatility(IV). I like the pull back today because it gives head room for a run back to new highs before the report. My line is 620, I got in at 626, with a projection of 650. I took it at 626, because during the day it was holding there but fell some, 620 is my line, if it closes below I will exit. It did fall below during the day but going into close rallied back above, it wasn't as strong as I'd like closing basically right at my line but it did rally, and I feel like it shouldn't have too much downside before earnings. Currently, I am down slightly(-220). Again if I am significantly in the money going into earnings I will hold. I feel if they have a good report with good guidance we see a gap up, since last report people sold so heavily, however it has ran up almost 100 points in a short time so we could see selling on the release. GOOG reports on thursday the 18th. risk reward is about 6:24, or 1:4, fits my criteria.

I bought 5 calls on FCX around 115.10, target of 120, earnings report on the 22nd as well. 110 is more significant support, 115 has been recent. I bought these in the middle of the day, I likely should have waited on all of these to the end of the day, however they were close to my entry points so it shouldn't matter. FCX was rallying into the close with the others so I stopped paying attention, but somewhat stalled and fell back below 114 so I am somewhat concerned. I should haved paid closer attention, so now I will have to watch it tomorrow, I am only down .75%(-275), so it is within my risk tolerance of 2%, normally I would want to only have to lose that much to determine an exit, in this case I am somewhat playing momentum and slightly looser. However, if I get down my 2% I will exit.

So overall on the day, I am down less than 1% in my portfolio overall, which I like on a day where the nasdaq was down 1%.

I can use that to illustrate the importance of position sizing, and minimizing risk. I waited and took positions at points close to where I would need to exit. Positions are small since that is needed to keep risk in check. I would like to be more diversified with some put plays, if earnings aren't as strong as people think the market may turn over again, it will likley be volatile for now.

I'll try and find some bearish plays tomorrow, Jeff Kohler releases his weekly watchlists on Tuesdays which are extremely helpful, if I see some bearish setups I like I will likely take some.

I'll post on my rules so they are more clear, a little later but wanted to get those out there with some thoughts on what I did and why I did it.

Sunday, October 14, 2007

"By the Grace of Kohler"

In June of 2007, after I had been trading options about a month I came across another blog after I was looking for technical analysis videos on YouTube. After watching a video he gave the address for his blog www.optionaddict.blogspot.com and the rest is history. :-)

I am always the first to give credit where it is due and I have to give almost all credit for my quick progression to Jeff Kohler. Jeff is an instructor at Investools and a professional trader. He also manages to run his amazing Option Addict blog. Everything up until I started reading Jeff's blog was simply information and ideas on how to succeed. Jeff was the example of success I needed with finite examples of trading that really hammered home concepts and made me change my old ways. I have to also give credit to the incredibley helpful community as well.

Through Jeff's blog I quickly saw the error of my ways and how I could improve my trading. I honestly believe that is the single resource anyone needs to learn to be a successful options trader as long as you can follow the rules you end up developing.

After learning technical analysis and reading Jeff's blog and exchanging a few emails I have since realized a few things are dumb to do if you are a trader.

Averaging down, if you chose a low risk entry point, you will never need to "average down" such as outlined in Cramer's books because if the stock drops you know to exit the trade.

Jeff's rules stress low risk, small position sizing, which is crucial to success. Before I would put on a huge position, thinking this was the way to make money. Having seen my new method work with way less risk, there is simply no reason to risk a high amount.

I have come up with my own trading rules after having learned from Jeff. These are basically Jeff's own rules but worded to my liking, I keep a copy of these on the wall next to my screens so I always have a reminder to not do something stupid and risk too much capital.

I cannot thank Jeff enough for the help and guidance he and the blog have taught me, hopefully I can help others through this blog and they can see value in my methods. Jeff is definitely someone I would like to meet someday and hopefully I will. By following my rules I learned I have been to get back to only 21% down from 50% down in the 3 weeks I have been back trading. Later I will describe how I now look and analyze all trades and why I think that way, which should help as I journal.

A little note about the title and picture. On Jeff's blog there was a down day in the market on thursday October 11th. Most people were upset and lost quite a bit of unrealized gains due to the unusual swing in the nasdaq. One blogger wrote "by the grace of God I had sold most of my positions earlier in the day". I posed to them that if it had been the "grace of God" then he must really love them and hate all the other Option Addicts to let them lose money. He then replied and said no it was actually due to his positions hitting their targets and being properly positioned and diversified that he was fine which was thanks to Jeff Kohler. I then decided he was actually saved "by the grace of Kohler". I liked that line and found it appropriate and humorous, hence its use here for my own situation. I have seen the light of Kohler, and it is good, lol.

Ben's Book Review

The Little Book That Beats the Market.

By Joel Greenblatt

This was the very first book I read on investing and stock picking. This is a great book for those just starting out and learning how to value stocks. It describes the concepts of valuation in very easy terms since he wrote the book to be readable by younger kids as well. Up to that point I had ideas on valuation, but this book gave good easy examples on picking stocks that were undervalued. The book basically referenced a "magic formula" which is basically high return on equity, high earnings yield and getting companies with little to no debt. His even setup a website www.magicformulainvesting.com for free and a few stocks I picked from there that I still watch would have yielded great gains(50%+). It is supposedly backtested to have returned 29% annually over 30 years.

I recommend this book for beginners just learning about stocks and valuation, very worth it.

Real Money: Sane Investing in an Insane world.

By James J. Cramer

Jim Cramer of Mad Money fame wrote this first book on investing. This book covers some good disciplines and has some good advice on how to pick stocks given the time in the economic cycle. Gives pretty solid advice on diversification and when to take risk. Gives good examples and also teaches about how to value stocks. It is easy to read and written in a fun kind of tone, if you have watched Mad Money you can see the personality come through in the writing.

I recommend this book for beginners learning about diversification, risk tolerance and economic cycles.

Mad Money: Watch Tv, Get Rich

By James J. Cramer

The second in his series of investing books, basically builds on Real Money with some good additions and newly found insights. Also talks about his show a little as well. One nice thing is it gives you a template on how to do homework on the stocks you are looking at to see if they are good candidates.

I would recommend this book if you have already read Real Money.

Confession of a Street Addict

By James J. Cramer

This is basically the history and background on Jim Cramer and how he got to where he is today and some of the interesting things that happened to him. I actually enjoy books like this because I like to see the history of those that became successful and how. Cramer is a talented writer, since he originally was a journalist, and the book is very entertaining.

I recommend this book if you are a fan of Cramer, it is well written and gives a great account of his journey to wall street and making money.

Seven Years to Seven Figures

By Michael Masterson

The only good information I got from this book was that if you want to make money and become a millionaire it must become your primary goal. I took this advice and hence started educating myself on the market and options. The rest of the book is worthless, you just get these stories from people that "did it" even though you have no idea how much they even started with. Page 40 basically tells you "it takes money to make money".

Do not waste your money on this book, I have given you the only valuable piece of information from it.

All About Option

By Thomas McCafferty

This is a good book for those looking to get information on options and different basic strategies to use. This will give you a good definition of options and will explain how they can be used more in depth. However this information is pretty much available online all for free.

Good for an intro to options but all the information can be found online from places like investopedia for free.

The Way of the Turtle

By Curtis Faith

Curtis Faith was supposedly the most successful of the "Turtles" a sort of experiment taking people with certain characteristics and seeing if they could be turned into good traders. This is a somewhat entertaining book, the story gives some good examples of why he succeeded and others failed, similar to the real world where 9/10 people fail to trade successfully. Basically the "secrets" of the turtles, are the usual let your winners run, cut your losses short. Add to positions if your position is being successful, only risk a finite amount and don't trade on emotion. Also, highlights the helpfulness of Technical Analysis.

Again another book to see how one person became a successful trader which I find interesting. I basically gave you the secrets and general themes, which should not be taken lightly because they are correct and should be followed if you wish to be successful.